No.

We have sent you a Notice of Valuation to tell you what the latest land value is for your property that will be used by your local council for setting your rating.

The Notice of Valuation is issued free of charge.

No.

We have sent you a Notice of Valuation to tell you what the latest land value is for your property that will be used by your local council for setting your rating.

The Notice of Valuation is issued free of charge.

The Valuer General provides land values to councils for rating purposes at least every three years. Landholders are issued with a Notice of Valuation to tell what their new land value is.

Notices of Valuation are issued each time a new valuation is made for council rating purposes.

You may receive a supplementary Notice of Valuation - see fact sheet (PDF 69.5 KB) if a new land value is determined outside of the usual three to four year valuation cycle. This may happen if changes to your property are recorded on the Register of Land Values.

Please contact us on 1800 110 038 or +61 2 6332 8188 (international callers), or write to:

Valuation NSW

PO Box 745

Bathurst NSW 2795

You should:

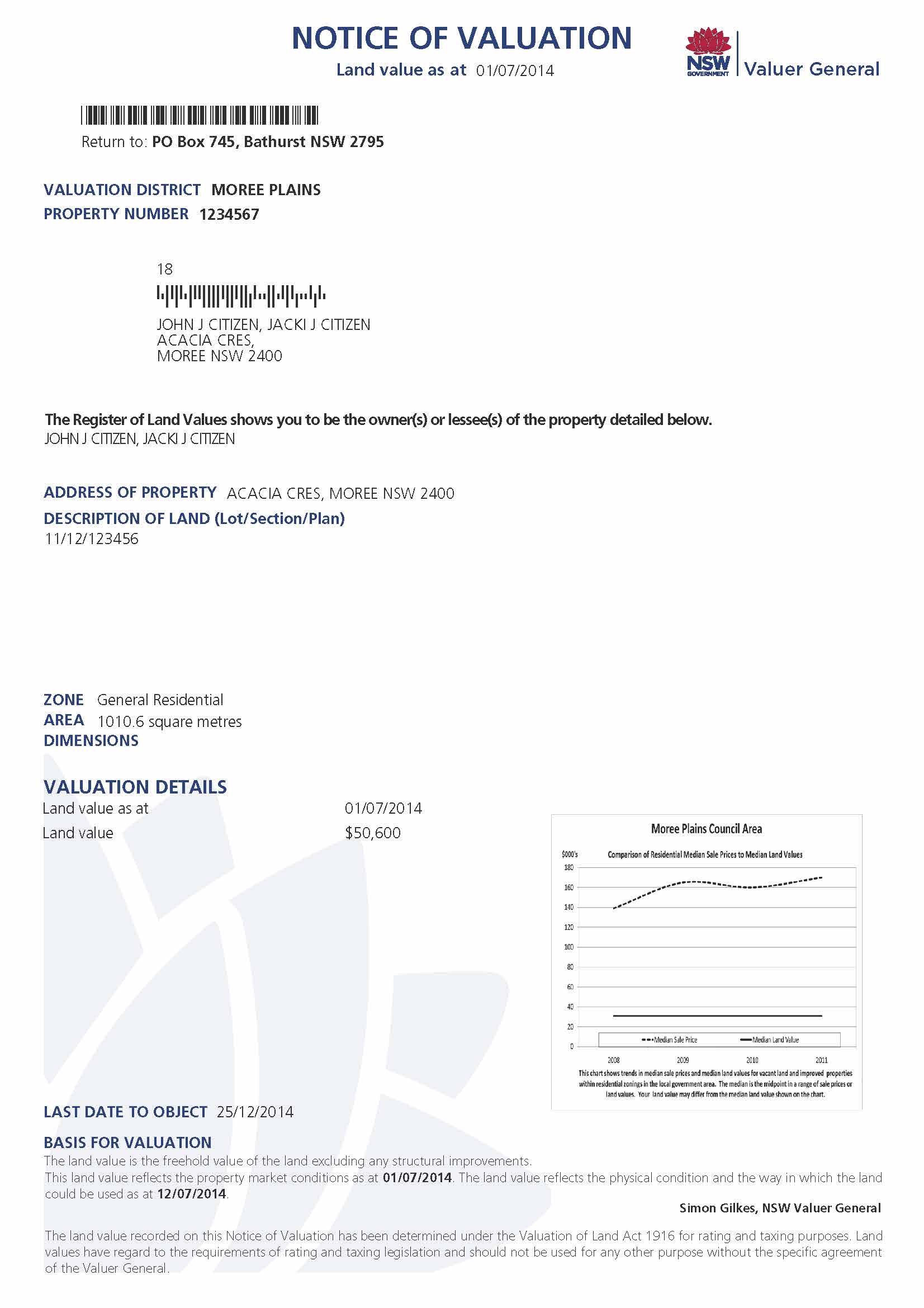

The Valuer General sends landholders a Notice of Valuation showing their land value when their council receives new values for rating. The Notice of Valuation gives landholders the opportunity to consider their land value before their council uses it for rating. You can find more information in land values, how do we value land.

The Valuer General sends landholders a Notice of Valuation showing their land value when their council receives new values for rating. The Notice of Valuation gives landholders the opportunity to consider their land value before their council uses it for rating. You can find more information in land values, how do we value land.

Notices of Valuation are issued at least every three years.

The Valuer General sends landholders a supplementary Notice of Valuation if we:

You can find more information on supplementary Notices of Valuation on our fact sheet (PDF 57.6 KB).

If you think the land value or property information on your Notice of Valuation is wrong you have 60 days to lodge an objection with the Valuer General to have it reviewed. You can find more information on lodging an objection here.

In most instances it has been at least three years since the land was last valued for council rating purposes.

Land is valued at 1 July of the valuing year and reflects changes in the property market since the previous valuation.

Factors our valuer consider when comparing property sales to the benchmark properties include the land's:

Any concessions and/or allowances applying to your land under the Valuation of Land Act 1916 will be printed on your Notice of Valuation or land tax assessment.

The legal effect of encumbrances such as easements, rights of way, title covenants, caveats and 'restrictions to user' are not considered when determining land values. Only the physical effect of encumbrances can be organised in the valuation and land value review process.

Personal circumstances, council rates and land tax liability are not considered when determining land value.

Most land is valued using mass valuation where properties are valued in groups called components.

Inspections of various sites are undertaken as part of the sales analysis and valuation program.

Heritage properties are recognised under two different Acts for rating and taxing purposes.

More information can be found in the valuation of heritage restricted land policy.

If you feel that features or your land or the surrounding area have not been considered, please refer to what if you have concerns.

You can use our land value search tool here.

Valuers can make individual valuations when needed. But for most land, we use a mass valuation approach that follows these steps:

| 1. Group similar properties |

Properties in a group have similar attributes and are expected to experience similar changes in value. These groups are known as components. |

| 2. Select primary and reference benchmarks |

Benchmark properties represent most properties in a component. Reference benchmarks represent higher and lower valued properties and other subgroups. |

| 3. Analyse a broad range of sales evidence |

Valuers analyse property sales, including vacant land and improved properties. They then adjust the sales price to:

See the benchmark component report for sales the valuer used to value the benchmark properties in your component for the 1 July 2019 valuing year. See the valuation sales report for some sales valuers considered during the valuation process. |

| 4. Value the primary benchmark |

Valuers individually value the primary benchmark to calculate the rate of change from last year. They consider factors such as the land’s:

|

| 5. Value the reference benchmarks |

Valuers review the values of the reference benchmarks against the component factor. They do this to check the quality of the proposed valuations. |

| 6. Apply the component factor |

Valuers apply the component factor to the properties in the component. This determines each property’s new land value. |

| 7. Check for quality |

Our quality assurance process ensures new values are accurate and consistent. For more information, see Quality assurance. |

Differences in land values between neighbouring lands are common. Your neighbour’s land may have a different shape, dimensions or area to your land. These factors may affect the way the land may be used or developed.

Some of the other reasons why your neighbour's land value might be different to yours are described below.

Your neighbour's land may have different physical characteristics that affect its land value. For example, your neighbour's land might have poorer views, a steeper slope or inferior access.

Land adjoining your land may be subject to different constraints. These may be due to zoning, easements, heritage restrictions or other constraints. For example, your neighbour’s land may have be subject to flooding which can reduce the value of the land.

Your neighbour's land may be used for a different purpose to your land (e.g. residential vs commercial use).

In some circumstances, concessions and/or allowances applying to land under the Valuation of Land Act 1916 (the Act), may reduce the land value.

If you feel that your land value is incorrect you may request a review.

The grounds for objection can be found in section 34 of the Valuation of Land Act 1916. A brief summary follows:

More information on lodging an objection can be found on the Request a review page.

You have 60 days to lodge an objection. The last date to object is printed on the front of your Notice of Valuation or 60 days from the issue date printed on their land tax assessment.

If you want to lodge an out of date objection you need to provide detailed reasons why your objection is late. We can then decide whether to accept the objection.

Examples of reasons for lateness include:

The Valuer General is not bound to accept an out of date objection for any of the above reasons for late lodgement.

You can lodge your objection online using our online objection facility. We also have an information kit which provides important information about the objection process. You can request an information kit using our online objection kit request facility or by calling us on 1800 110 038 or +61 2 6332 8188 (international callers).

You can find information to help you lodge your objection in the Your guide to the Valuer General’s review process (PDF 1.4 MB) booklet. You can also call us if you need help with your objection.

If you don’t have access to the internet, you can contact on 1800 110 038 to discuss your options.

Land values are one factor used by councils in the calculation of rates.

Increases in land values do not necessarily lead to similar increases in rates.

If you would like more information on the calculation of your rates you should contact your local council.

The Valuer General gives councils new land values at least every three years.

You can find the valuation schedule for council rating here.

No, registered land tax liable landholders are notified of their land values through a land tax assessment issued by the Revenue NSW.

Contact the Revenue NSW on 1300 139 816 (within NSW) or 02 9685 2155.